- #When will the irs start processing electronic returns for free#

- #When will the irs start processing electronic returns how to#

- #When will the irs start processing electronic returns update#

Recommended Reading: When Is The Tax Filing Deadline For 2021 How We Make Money The IRS will charge interest and sometimes late payment penalties if you don’t pay by then. Payment of any taxes you owe for the year are still due by the May deadline, however. Its a simple matter of filing Form 4868 rather than a tax return by that date. Those living in other states can request a six-month extension from the IRS, pushing the filing deadline back to October 15 of this year, if they’re not ready to prepare and file their tax return by May 17. Residents of Texas and surrounding states that were declared to be winter storm disaster areas have even more time to file their tax returns, until June 15, 2021. It means that payments aren’t due until May 17, either, with the exception of estimated tax payments. This provision only applies to individuals, not corporations. The IRS extended the tax filing deadline from April 15 to May 17 in 2021.

#When will the irs start processing electronic returns update#

They do not update the status more than once a day, so checking throughout the day will not give you a different result. Note that the IRS only updates tax return statuses once a day during the week, usually between midnight and 6 am.

You can also call the IRS at 1-80, or 1-80, or 1-80 and inquire about your tax return status with an IRS a customer service representative. The best way to check the status of your federal tax refund is to visit the Wheres My Refund page at the IRS website. You will need to wait at least 4 weeks if you mailed in your tax return. You should be able to check IRS tax refund status roughly 24 hours after your receive confirmation from the IRS that they have received your tax refund via E-File.

#When will the irs start processing electronic returns how to#

How To Check The Status Of Your Tax Return Having a knowledgeable tax professional, such as an enrolled agent, certified public accountant or other tax professional can help review your tax return and identify any mistakes that may slow down the processing of your tax refund. If your tax situation is more complicated if you sold property, paid business expenses or earned investment or business income, for exampleyou should consider hiring a tax professional. Most simple tax returns can also generally be filed for free, although you may be charged to file your state taxes.

#When will the irs start processing electronic returns for free#

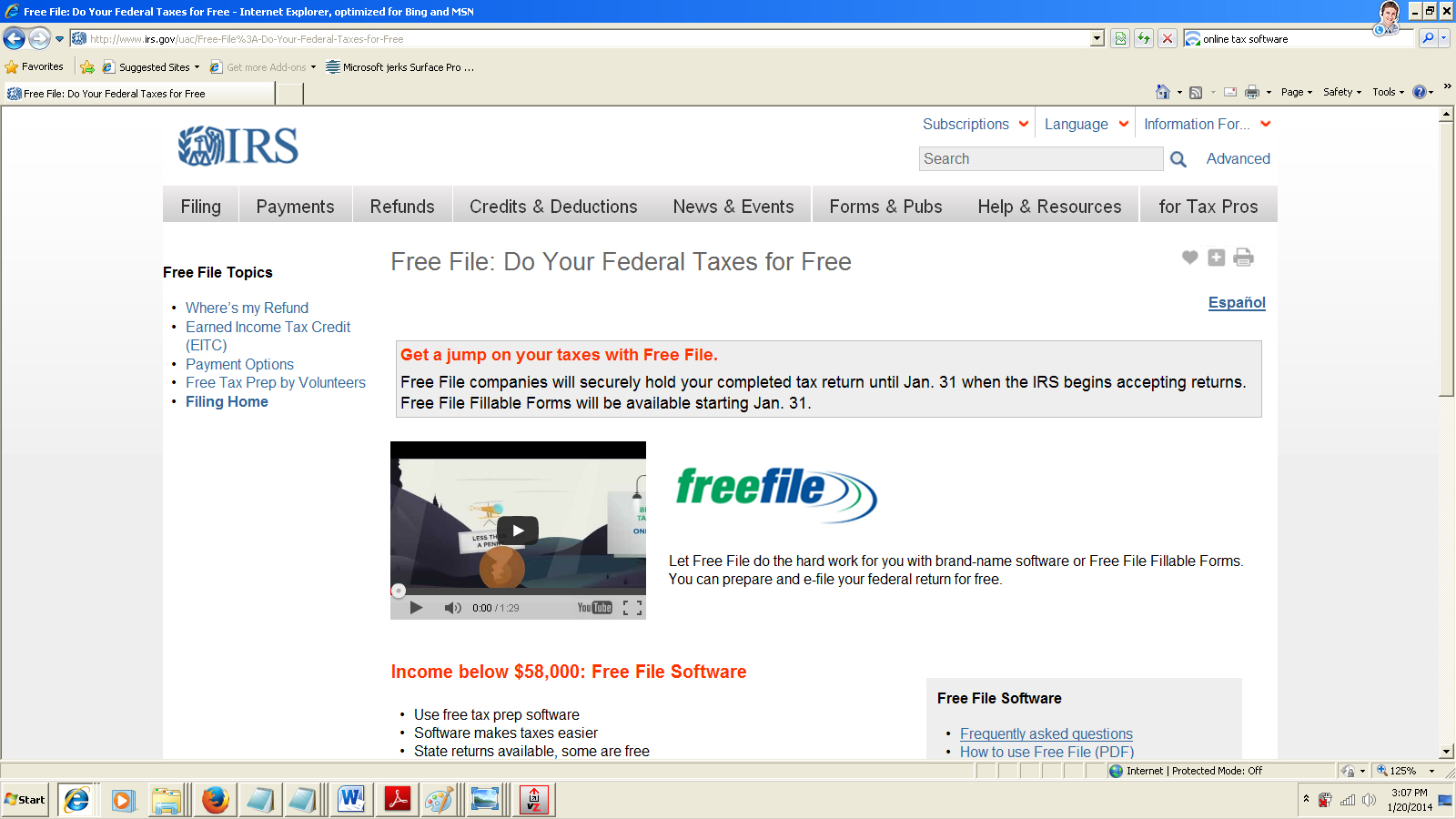

You can electronically file your tax return for free using the IRS Free File Program if your adjusted gross income is less than $72,000. These errors may include incorrect Social Security numbers, dependents dates of birth, and misspelling of names. Since filing electronically requires the use of a tax software program, it can flag errors that may cause processing delays by the IRS. What date will the IRS start accepting tax returns?Ĭombining both direct deposit and electronic filing can greatly speed up your tax refund.

0 kommentar(er)

0 kommentar(er)